A judge and two lawyers" width="750" height="370" />

A judge and two lawyers" width="750" height="370" />Workers' comp settlements can be a simple matter – or a stressful court battle. Learn what’s involved, how settlements are calculated, and ways to reach an agreement with your employee.

A judge and two lawyers" width="750" height="370" />

A judge and two lawyers" width="750" height="370" />

Workplace accidents and injuries are an unfortunate fact of business life – and an expensive one.

Private employers reported 2.6 million nonfatal workplace illnesses and injuries in 2021, according to the U.S. Bureau of Labor Statistics. Each week, U.S. companies pay an estimated $1 billion on disabling workplace injuries.

To protect employers and workers from the financial risks of workplace injuries, nearly every state requires businesses with employees to carry workers’ compensation insurance. This no-fault coverage protects you from employee lawsuits related to injuries. It also protects injured workers by covering costs such as:

Filing a workers’ comp claim can be simple. But settling one is often a different story.

When you and your injured worker understand workers’ comp settlements, the process will be smoother for everyone. To learn more, let’s take a look at:

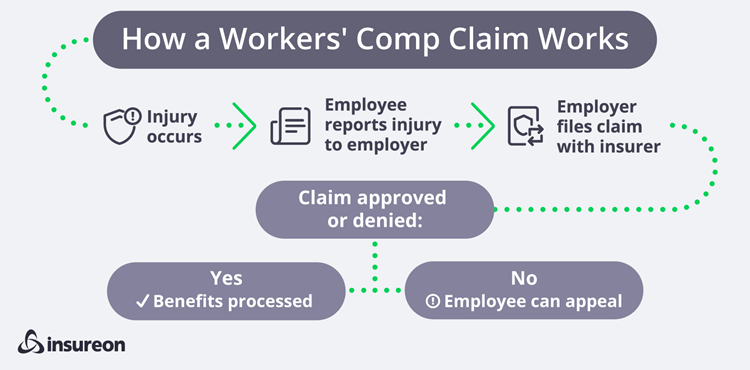

Employers and employees each play an important role in the workers’ comp claim process.

When an employee suffers a work-related injury, they must quickly report it to their employer or risk losing benefits. States have various deadlines for reporting a workers’ comp injury, ranging anywhere from 72 hours to two years. Most typically require a report within 30 days to start the workers’ comp claims process.

Once a claim is filed, the workers’ comp insurance company will either approve or deny it. You may be involved if an investigation into where and how the injury happened is needed. The insurance company may also review medical files and accident reports.

Insurers usually deny claims for injuries that:

The injured worker may appeal the denial and possibly hire an attorney to represent them. The appeal process typically involves an administrative hearing. You can learn more about the hearing process in the role of workers' comp hearings below.

If the workers’ compensation claim is approved, the insurance company will pay for any medical expenses related to the injury.

While an employee is unable to work, they will receive a portion of their wages as a weekly benefit. Your workers’ comp insurer will also pay these temporary total disability benefits (typically two-thirds of the employee’s regular pay).

Temporary total disability benefits end after an employee returns to work – even if they still have an open claim. For example, let’s say a worker trips and sprains their ankle on the way to get coffee in the office break room. They’re able to work, but they continue to receive physical therapy.

The insurance company would continue to pay for any medical bills related to the claim. Because the employee’s back at work, their temporary disability benefits would end.

Some employers also develop return-to-work programs to help get their injured employees back on the job. These programs come with significant benefits.

If an employee refuses an offer of light or modified duty work by an employer, in some states they may lose additional benefits.

Your goal should be to get your injured worker healthy and back on the job as quickly as possible. A return-to-work program can help.

This option typically lets an employee perform light or modified work that’s less taxing than their normal responsibilities. Be sure to formally document your plan.

For employees, benefits may include:

For you, the employer, the advantages can include:

Be sure your program encourages injured workers to return to work when they’re ready, and doesn’t pressure them to come back prematurely. Leave it to the medical professionals to make those decisions.

If an employee refuses an offer of light or modified duty work by an employer, in some states they may lose additional benefits. That’s why it’s critical for workers and employers to know employees’ rights in their state.

Done right, a return-to-work program can help pave the way for a smooth claim resolution.

If a worker recovers fully and goes back to work with no outstanding bills or unpaid benefits, the claim can simply be closed.

In many states, closing a claim involves a settlement negotiated between the insurer and the injured worker, often through their attorney. (If the parties can’t reach an agreement, a judge will need to decide after a hearing, described in detail in the next section.)

The settlement process typically begins with an offer from the insurance company and employer. This may include payment for unpaid benefits or medical bills, as well as costs of future treatment. If an injury leaves a worker permanently impaired, they may also be entitled to a disability award to compensate them.

A work injury settlement can be either a lump sum or a structured payment plan:

Before a settlement is reached, the employee and their attorney calculate what they think the workers’ comp payout should be. It should be enough to cover previous medical care and future medical costs. The settlement should take into account:

Once the calculation is finalized, the employee and their attorney will negotiate with the insurance company. Typically the final settlement is a compromise between the two parties.

In many states, a workers’ compensation judge must review the proposed settlement before it’s finalized. The judge will consider whether it’s fair to the employee, but it’s always helpful for the injured worker to have legal representation to protect their interests.

Your role is minimal during settlement negotiations. Still, keep the lines of communication open and stay updated on progress.

Settlements may take weeks or months to hammer out. During this time, be sure your employees know their return-to-work options. Injured workers who are kept informed and know their options are less likely to sue.

If the insurer and the employee can’t reach a settlement, then they’re probably headed to court for a hearing. That can be a bit of a gamble for both sides.